All Categories

Featured

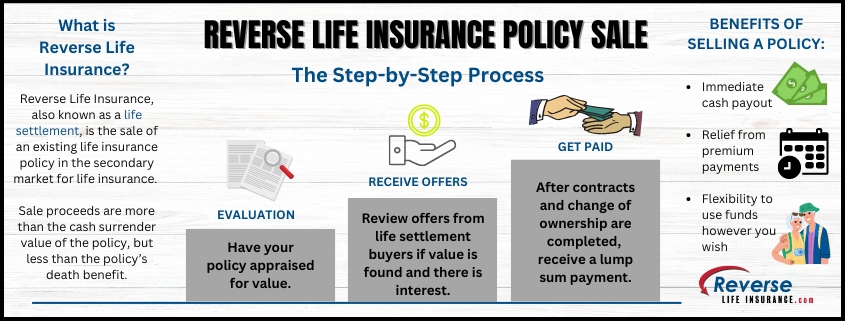

Money worth is a living benefit that stays with the insurance provider when the insured passes away. Any exceptional loans against the money worth will certainly lower the plan's survivor benefit. Family protection. The plan proprietor and the guaranteed are usually the very same individual, but occasionally they might be different. A company may get key person insurance policy on an essential employee such as a CHIEF EXECUTIVE OFFICER, or a guaranteed may offer their own policy to a third celebration for cash in a life settlement - Wealth transfer plans.

Latest Posts

Funeral Insurance Definition

Published Apr 13, 25

6 min read

Funeral Cost Cover

Published Apr 06, 25

8 min read

Universal Life Insurance Quotes Online Instant

Published Apr 04, 25

6 min read